wise county virginia tax office

Looking for Wise County Revenue Commission property tax assessments tax rates GIS. On the Pay Personal Property Taxes Online Screen press the button containing your preferred method for finding tax information.

April Foolish Fuels Day In Wise Va The Understory Rainforest Action Network

Monday through Friday.

. They are a valuable tool for the real estate industry offering both buyers. The Wise County Treasurer oversees an office with an annual operating budget of over 700000. Use the links on the left side of the screen for navigation.

Real estate property records are accessible to the public. The Wise County Tax Office collects ad valorem property taxes for Wise County and 24 additional taxing entities. The Wise County Treasurer and Tax Collectors Office is part of the Wise County Finance Department that encompasses all financial functions of the.

This site can be used to make online payments to the Town of Wise Treasurers Office and inquire into tax ticket information from the comfort of your home or office. There is 1 Treasurer Tax Collector Office per 19769 people and 1 Treasurer Tax Collector Office per 201 square miles. The method of appraisal utilized by the Wise County Assessment Team is also mandated by Virginia State Law.

If you have documents to send you can fax them to the Wise County assessors office at 276-328-6937. Additionally the Tax AssessorCollectors office also issues tax certificates conducts Sheriff Sales for real and personal property. Verify the numbers are correct press the Search button and the Total Bill.

Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. The purpose of the Assessment Office is to ensure fair and equal taxation by employing established methods of appraisal in combination with cutting edge technology. From the time a payment is submitted there are 3 to 7 business days before the Tax Office receives the funds.

Wise County Tax Office. The Wise County Taxes Department located in Wise Virginia is responsible for financial transactions including issuing Wise County tax bills collecting personal and real property tax payments. View All News.

830 am to 430 pm. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records.

To 430 p. Property Taxes Mortgage 4373400. View 445 Woodland Court Southeast Wise Virginia 24293 property records for FREE including property ownership deeds mortgages titles sales history current historic tax assessments legal parcel structure description land use zoning more.

The information contained within this site is provided as a public service by the Wise County Commissioner of the Revenues Office. You can call the Wise County Tax Assessors Office for assistance at 276-328-3556. Closed for lunch from noon to 1.

Payments made by credit card will be posted in the Tax Office after the funds are received in the Tax Office bank account. 830 am to 430 pm. Pay Using Department Number Ticket Number - Enter the Department Number and Ticket Number.

Payments can also be placed in the DROP BOX. These records can include land deeds mortgages land grants and other important property-related documents. Registration Renewals License Plates and Registration Stickers.

These records can include Wise County property tax assessments and assessment challenges appraisals and income taxes. Remember to have your propertys Tax ID Number or Parcel Number available when you call. The deadline to pay the first half of Wise County 2022 real estate taxes is May 31 2022.

Closed for lunch from 1200 - 100. Ad Pay Your Taxes Bill Online with doxo. The Town of Wise Treasurers Office is pleased to offer Online Payment and Inquiry System.

Their office is accountable for over 121 million in county revenues including County funds and school funds. Wise County Land Records are real estate documents that contain information related to property in Wise County Virginia. 8 am to 430 pm.

Tax payments made by 1200 midnight on the last day of any month will be honored as having not accumulated. They are maintained by various government offices in Wise County Virginia State and at the Federal level. Wise County VA property tax assessments.

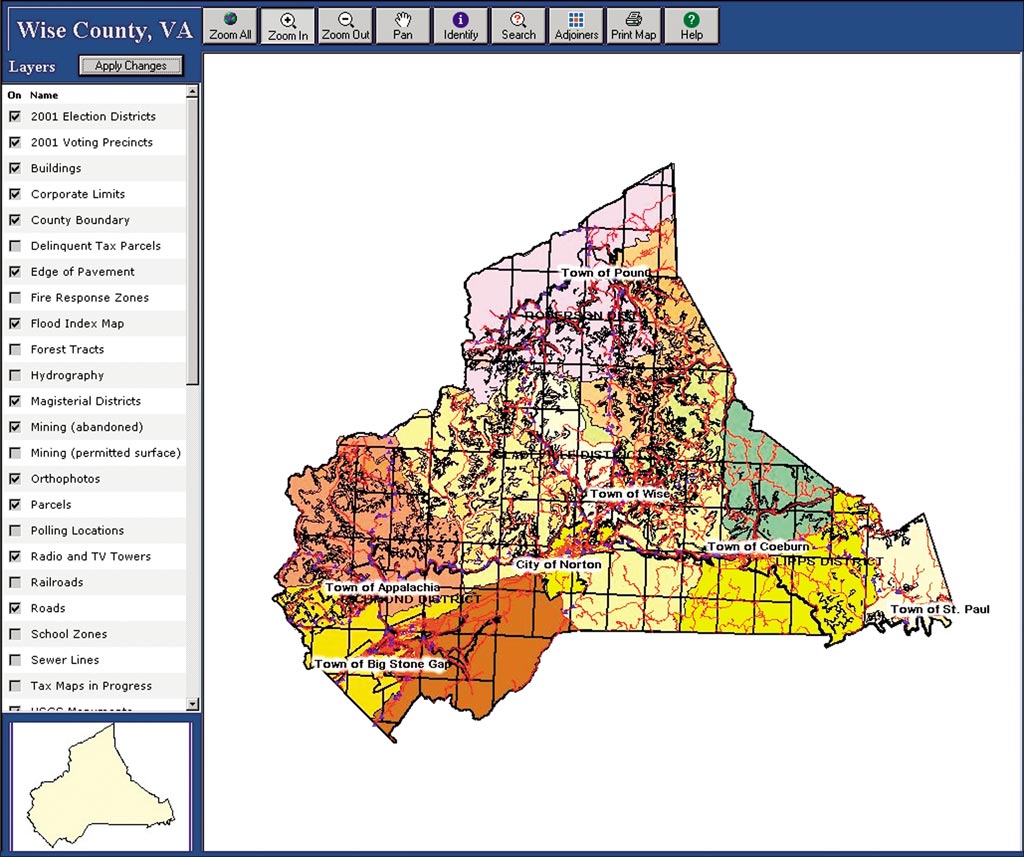

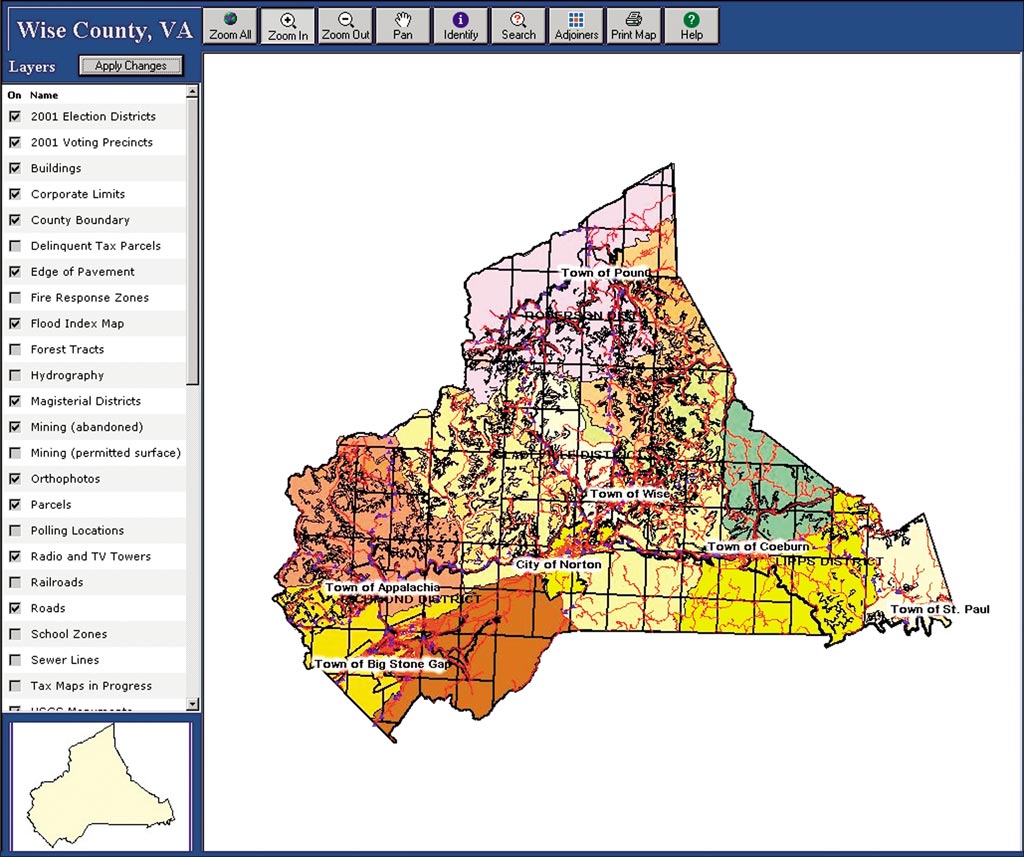

Visit the Wise County GIS website to view parcel information online. The Clerks office ensures that public records are retained archived and made accessible to the public in accordance with all laws and regulations. Payments may be made to the county tax collector or treasurer instead of the assessor.

The deadline to pay the first half of Wise County 2022 real estate taxes is May 31 2022. Ad Uncover Available Property Tax Data By Searching Any Address. Department Ticket Number or Account Number.

County tax assessor-collector offices provide most vehicle title and registration services including. Property owners may contact the Assessment Office for questions about. The information contained within this site is provided as a public service by the Wise County Commissioner of the Revenues Office.

Tax Rate Billing Dates. Land Records are maintained by various government offices at the local Wise County Virginia State and Federal. Payments can be mailed to Wise County Treasurer P O Box 1308 Wise VA 24293 or paid in person at the Wise County Treasurers Office located in Wise during regular office hours of 800 a.

FY 2022-23 Proposed County Budget is available for download. The office works closely with the public as well as the Clerk of the Circuit Court Office and the Treasurers Office. Please contact your county tax office or visit their Web site to find the office closest to you.

Wise County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Wise County Virginia. The Wise County Tax Assessor can provide you with a copy of your property tax assessment show you your property tax bill help you pay your property taxes or arrange a payment plan. The Wise County Clerk located in Wise Virginia is the official keeper of public records for Wise County.

There are 2 Treasurer Tax Collector Offices in Wise County Virginia serving a population of 39539 people in an area of 404 square miles. In Virginia Wise County is ranked 61st of 133 counties in. The real estate tax rate as of January 1 2019 is 069 per 100 of.

Certain types of Tax Records are available to the general. We Provide Homeowner Data Including Property Tax Liens Deeds More. Please call the assessors office in Wise before you send documents or.

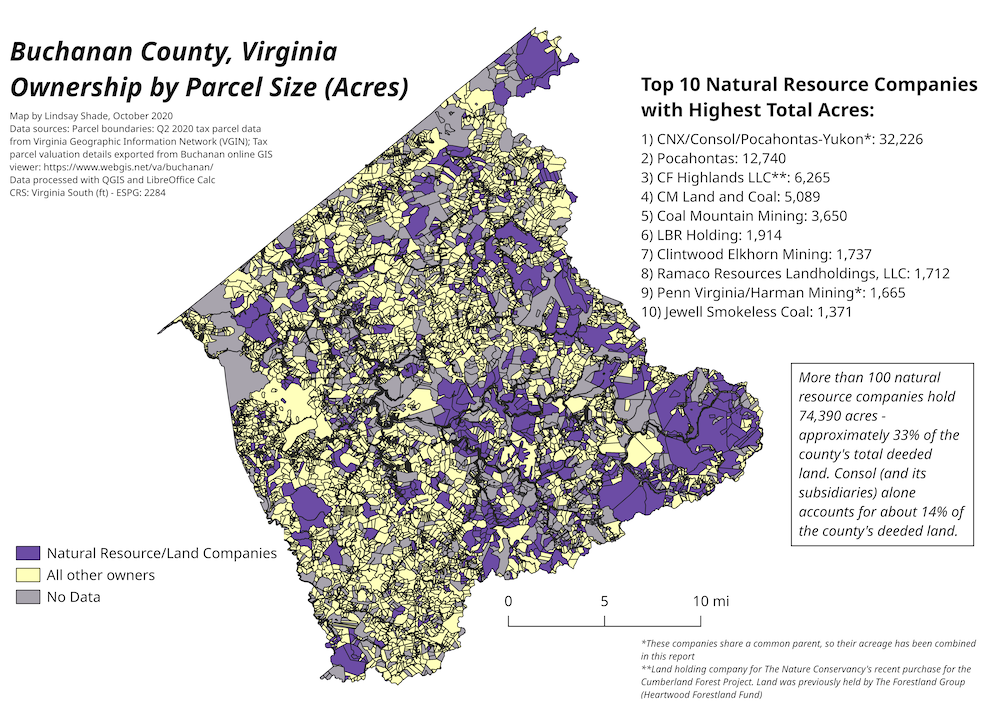

Fighting For Equitable Land Access In Southwest Virginia Appalachian Voices

Fighting For Equitable Land Access In Southwest Virginia Appalachian Voices

These 11 Towns In Virginia Have The Lowest Taxes

Virginia Assessor And Property Tax Records Search Directory

Assessment Office Wise County Va

Virginia Tax Assessors Your One Stop Portal To Assessment Parcel Tax Gis Data For Virginia Counties

The Inn At Wise 159 1 9 3 Updated 2022 Prices Reviews Va

April Foolish Fuels Day In Wise Va The Understory Rainforest Action Network

Personal Property Wise County Va

Paying Your Taxes Wise County Va

Coal Fuels Less And Less Virginia Electricity But When Should Utilities Pull The Plug On Plants Virginia Mercury

Fincastle Turnpike Wilderness Road

Esri News Arcnews Spring 2002 Issue Wise County Virginia Puts Students On The Map

Va S Reliance On Tax Credits For Land Conservation Is Certainly Not Equitable Review Finds Virginia Mercury